One of my favorite trades for option sellers is a seasonal commodity trade you can use almost every year. I’m almost certain I’ll be placing this or a similar trade in Spring/Summer of 2019. It […] Read More

Commodity Option Selling is an alternative to Stock Market volatility. No matter what stocks you are in, the DOW is the tide that raises and lowers all boats. When the stock market is sideways to […] Read More

Nervous Stock Market Bodes Well for Gold Futures Stock market uncertainty creates opportunity in option sellers gold puts for income. Historically, the greater the volatility and those daily sell-offs and run-ups of the stock market, […] Read More

What is Different Now That Crude Prices Dropped over 30% Option sellers could find opportunity in crude oil prices for 2019. A new trading range will be developing soon. The April 2019 crude oil futures […] Read More

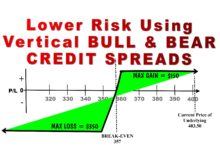

Limiting Risk and Margin with Vertical Credit Spreads is an alternative to other more risky strategies, such as naked options. These spreads, like many strategies – can be used in harmony with seasonal trends of commodities, […] Read More

Learn Fast and Easy with these 6 Steps: Learning to trade commodity markets can be much easier when you take an organized approach. Here are a few simple steps to help you learn to understand […] Read More

Is TastyWorks the ThinkOrSwim Next Generation? TastyWorks Review 2019: ThinkOrSwim is great. I’ve been using it since 2003. The fact that it served as the ‘top gun’ trading platform for 20 years is remarkable – few […] Read More

Soybean Fundamentals Selecting soybean call option for profits: I often stress the importance of following the grain fundamentals via the USDA reports, especially the WASDE (World Supply-Demand Estimates.) The current corn harvest in progress has […] Read More

Trading Hours for Futures and Options You need to know the very best trading hours for Futures and Options. If you are new to this trading, this short explanation will help you avoid some confusion […] Read More

Margin Requirements: Money Management When Selling Options: This is one topic I get the most questions and email about on this blog and the Time Farming newsletter. The question is, “How many commodity markets and […] Read More