Learn Fast and Easy with these 6 Steps:

Learning to trade commodity markets can be much easier when you take an organized approach. Here are a few simple steps to help you learn to understand the mechanics and terms in trading commodity futures contract and options on futures. Going through this checklist step-by-step is all it takes for a solid introduction to each commodity market. A market means: corn, crude oil, gold, soybeans, natural gas, silver… and so on. Each of the markets may have unique unit values and characteristics with which you need to be familiar.

FOR EACH MARKET YOU TRADE: The unit values you use when trading, contract values, tick values, trading hours, the exchange where it is traded, and contract specifications may be different in each market. Learning them one-at-a-time is a targeted approach that avoids a lot of confusion and it keeps you focused on the basics you need to know.

The 6 Fast-Start Steps Learning to Trade Commodity Markets

- Learn markets one at a time.

- The Contract Specifications. For Months traded and Symbols DOWNLOAD HERE.

- Unit Values: Converting units to dollars, minimum tick values

- Trading Hours For popular futures trading hours: CLICK HERE

- Research: Market Fundamentals

- Learn Using Trade Simulation

#1: LEARN MARKETS ONE AT A TIME

If you try to learn all the markets at once, it will be very confusing, so take them one at a time. Take notes on each market. Keeping your notes similar for each market will give you a uniform format to use while learning. You may wish to make the following headings for each individual market you study. The most typical and popularly traded commodity markets are: corn, soybeans, wheat, crude oil, gold, silver, and natural gas.

NAME OF MARKET:

SIZE OF CONTRACT:

VALUE OF A CONTRACT:

INCREMENTED VALUES AND MINIMUM TICK VALUE OF THE CONTRACT:

INCREMENTED VALUES AND MINIMUM TICK VALUE OF THE OPTIONS:

EXCHANGE:

TRADING HOURS:

THE SYMBOL FOR THE CONTRACT:

THE NAMED MONTHS AND SYMBOL FOR EACH CONTRACT:

THE NAMED MONTHS ON WHICH OPTIONS ARE AVAILABLE TO TRADE:

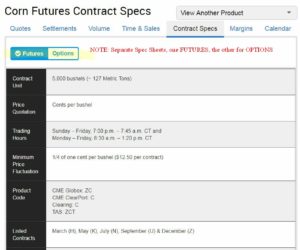

#2: CONTRACT SPECIFICATIONS

Contract Size

By definition, each futures contract has a standardized size that does not change. For example, one contract of corn represents 5,000 bushels of a very specific type and quality of corn.

Contract Value

Contract value, also known as a contract’s notional value, is calculated by multiplying the size of the contract by the current price. For example , a Corn contract value (5,000 bushels) is 5000 times the price of a bushel. If the named contract is trading at 400 ($4.00) per bushel, the contract value is $20,000.

Tick Size

The minimum price change in a futures or options contract is measured in ticks. A tick

is the smallest amount that the price of a particular contract can fluctuate. Tick size

varies from contract to contract. See the contract specification sheet to find incremental and tick values in each market of futures and options for the commodity.

Contract Specification Sheet: You can Google a term to find it. For example: contract specification sheet corn CME group will give a search result to this page https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/corn_contract_specifications.html?optionProductId=&optionExpiration=Q5

Please notice for each commodity there is a “spec sheet” for FUTURES and another for OPTIONS. You should use the official exchange provided spec sheets to make sure you have the most up-to-date information, or you can ask your broker if they provide spec sheets on their website. And if not, they can tell you where to find any spec sheet you may need.

It is better to download the official spec sheets from the respective exchanges, but here is a quick reference list you can DOWNLOAD

#3 Unit Values, Minimum Tick Values and Value of Each Tick

This information is on the CONTRACT SPECIFICATION SHEET. Remember there are two sheets: one for Futures and the other for the Options on those Futures. The tick values and minimum ticks are often not the same for the Futures and the Options. For example, the minimum tick value for Corn FUTURES is .25 cents AND the minimum tick value for the Corn OPTIONS is .125. When trading Corn .25 cents is equal to $12.50, and .125 cents is $6.25. Each one cent in corn 1.0 = 5,000 bushels per contract multiplied by 0.01 dollars = $50 per one cent (0.01 $US Dollar.)

#4 Trading Hours

Most futures contracts trade 23.5 or 23 hours per day. Most often the term used for this almost 24/7 trading market is Globex. While in theory, one can trade almost 24/7 in almost all markets this is not really practical due to very low activity in the overnight Globex. Low trading volume can and often does result in wide gaps between bid/ask prices and /or inefficient pricing in markets. Let me put this into plain language for you: You do not want to trade except during the most active hours. These hours are sometimes called the “pit hours” – a term pre-dating electronic trading. I made a list of the main hours for maximum activity for the most popular contracts; you should go by these hours: Read this article for details and the article has links to download a PDF and XLS sheet for popular futures trading (pit hours) hours: CLICK HERE

#5 Research: Market Fundamentals:

This short article cannot tell you how to research each commodity you might choose to trade. Since commodity futures and options on futures have an underlying contract based on a physical and tangible product, your research will be about the supply-demand characteristics of the commodity. Typically, the markets traded most by individual investors are: corn, wheat, soybeans, crude oil, natural gas, gold, and silver. There are many sources of research information, many are free and many are paid services that provide opinions and formatted research information for trading. The most free comprehensive data can usually be found on public, government websites such as the USDA (United States Department of Agriculture) and the EIA (Energy Information Agency.) Many major universities also provide free information through their Agricultural Economics and Business Departments. After you complete steps #1 through #4, you should set out to collect information on each individual market to help you with learn what fundamentals and other data influences its price.

#6 Learn Using Trade Simulation:

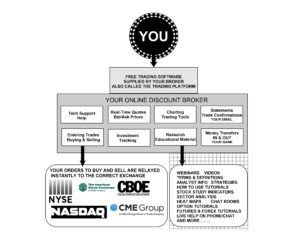

The one thing between you and all the trading markets is your trading platform. This is the software provided by your on-line broker. Your trading software is the greatest trading tool ever devised. The first thing you should in your account is sometimes called paper-trading. This is where you get practice everything you learn before risking you money in trades. It gives you price quotes, charts, option parameters and quotes, and the ability to see and learning using real-time prices. Whether you use a broker’s practice account or just track your practice trades in your notes, this is the step that puts it all together. All the terms you’ve needed to learn, the tick values, option strategies, and getting in and out of trades, all come together at once for the ultimate learning experience. In learning to trade commodity futures and options on futures, you’ll need to use a broker that provides the lowest margin requirements and that has the proper setup and execution for stock and commodity markets. More about that in a moment. The illustration below will give a quick overview of what your broker should provide in addition to free quotes, low commissions, and easy-to-use free software.

Just as you cannot learn to drive an automobile by only reading about it, you won’t be able to trade without having the experience of using your trading software. Tracking your trades using the paper-money approach and interacting with your software will allow you to gain valuable experience. You’ll be learning to find the markets and quotes you need, locating your charts, and how to open and close orders, as you build watch-lists to follow the markets and options you will be trading.

Your trading platform is the only interface between you and the trades in the markets; learning it is not optional.

The trading software of one broker compared to another is not the same; some can take hours of study and others are simple and intuitive to use. So before you select a broker to trade commodities and options on those commodities, you need to be sure you have the following very important things before you make a final decision:

Low Commissions: Getting low commission rates without great customer service is a mistake. Saving a dollar a trade is not worth the frustration and time you will waste due to poor help from you broker.

SPAN Minimum Margin Rates: If you are a beginner, you probably won’t have any idea what this is. Before you place a commodity trade whether using futures or the options on futures, your account balance will have to have an amount of money available called the initial margin deposit. The broker you want to select will want to use will require the least money possible for you to make the trade. This is called the SPAN minimum initial deposit or simply “using SPAN minimums.” Why do you want SPAN minimums? Because you will want the highest ROI (Return on Investment) possible.

Easy-To-Use Software: Of all the things you require, this is often the most difficult to find. If you are new, this is a sort of “Catch-22.” If you have no or little experience, how do you know which is the best software – if you have nothing to compare it to? It is very disheartening to spend a few days opening a new account and then invest hours learning to operate software only to find out there’s something better at another broker. Or maybe you like the software and find out other brokers have lower margin requirements and smaller commissions. I have known many people that have gone through this – and it isn’t fun at all.

Live-Operator Customer Service: Sometimes the broker with the lowest commissions will have higher margin requirements, and/or lousy customer service. You want service with a live, knowledgeable customer service people – or you can wind up 20 minutes on hold and get a scripted-answer operator (like the cable company.) It is also a plus if you can find a broker that allows you to transfer funds via ACH (free -no charges to-and-from you bank – a great many of them do this now.) It also helps if a broker has a fast and simple on-line application process to open the account.

Hundreds of people read my newsletter and thousands have read my trading books over the years. I am often asked these questions about brokers:

- Where should I open an account?

- What’s the minimum deposit to open an account?

- Who has some of the lowest commission rates found anywhere?

- Do they have SPAN minimum margins?

- Who has the best help when I need it?

- Is the software easy to learn?

- What broker do you use?

I have two favorites that I personally use and recommend: ThinkOrSwim and TastyWorks

One of them is much easier to use, has the lower commissions of the two, and offers both domestic and overseas accounts in more than 40 countries, and a very fast and simple on-line application to open an account – as well as free ACH money transfers.

If you’d like to see the one I recommend most often and why, just click this LINK.

Thank you for visiting my blog. I hope these notes help you in learning to trade commodities – and finding the broker that’s just right for you.

All the best – Don

Don Singletary