What is Different Now That Crude Prices Dropped over 30%

Option sellers could find opportunity in crude oil prices for 2019. A new trading range will be developing soon. The April 2019 crude oil futures dropped from a high of US$76.01 down to a low of $50.07 since October 3, 2018, a 30% decrease in just under 60-days.

What is different now than two months ago? If you are thinking “not much,” you are right. In the first week of October the deadline for allied oil sanctions compliance against Iran was approaching on November 6th. Talk of $100 a barrel oil was common. According to news stories, Saudi Arabia would step up production to make up for shorter oil supplies due to the Iranian sanctions and the lower output from Venezuela. The November 6th date came and went and oil prices had dropped from $76 down to the around $65, about where they were in mid -September. Many of the United State’s allied nations that were threatened to be sanctioned if they continued to buy Iranian oil, either ignored the threats or – at the last minute – were suddenly given “pardons” to remain largely exempt from the sanctions.

Then came some huge sell-offs in the stock markets world-wide. Naysayers came out of the woodwork speaking of an impending world economic slow down. The NYSE’s DOW average had fallen from almost 27,000 down to near 24,000 by the end of October. More “experts” reminded us all that the 10 year long bull stock market may have run its course, so the market DOW average immediately ignored them – and gained back 2,000 points, rushing back up from 24,000 to 26,000 in only 10 days. In the next 14 days, by the end of this month (NOV18), the market remains between 25,000 and 26,000. At this time, the “expert economist” exuding with self-renowned credentials are eagerly taking their chairs in front of the CNN, FOX, NBC, and Bloomberg TV cameras to talk down the chances of any sustained world economic growth. Unfortunately, it has become common practice to bring out these see-sawing panels of experts to fill these hundreds of hours of time on the financial channels. And like theater patrons at a good movie, the public seems perfectly willing to suspend their disbelief and buy into whatever gloom or glory du jour the media dishes out to them.

What is definitely different than two months ago is that oil price are lower and there seems to be little likelihood of any rebound in the immediate future for prices to approach $80 per barrel.

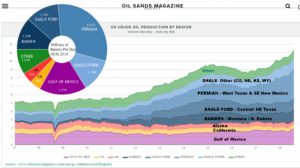

United States of America: Daily Crude Oil Production Growing

Current Estimated Production: 2018 Near 11.8 Million BPD (Barrels Per Day) and will soon be over 12 million bpd in 2019. Without crude prices of under $30 a barrel, this seems to be a certainty.

source: Oil Sands Magazine https://www.oilsandsmagazine.com/energy-statistics/usa#Imports

Option Sellers Opportunity in Crude Oil Prices for 2019

By mid December, the G-20 conference and the December 6th OPEC meeting will be done – and crude could easily find a short-term bottom and provide a setting for some modest recovery in prices in the first half of calendar 2019. Consumer confidence and spending remain robust. As this continues into the new year, there is still some room for crude prices to drop a bit more, while a full-on rally back to prices near $80 by mid-year – doesn’t seem probable – given the world-wide momentum for oil producing nations to keep production near present levels. Currently World Crude Oil production is near 82 million barrels per day. Short term production cutbacks of one to three million bpd would represent a change of only 1.2 to 3.6%. Any slow-downs of the worldwide economies might result in weaker oil pricing, and without confirmation of a huge boost in the global economic picture – a price recovery of large magnitude seems doubtful.

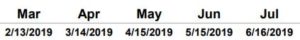

After the OPEC meetings December 6, we’ll see what cuts, if any, might be done in the short term. After that, I could be shopping either CALLS strikes near $80 and PUT strikes at $35 and under – to place trades of short CALLs – OR short strangles at those levels. For the shorter-term I might consider the MAR19 option class – and if the price behavior indicates less volatility, I could go out as far as JUN19 crude options. Currently, the JUN19 80C/30P strangles are priced just over $500. The JUN19 $90C/30P strangles are near $350. The JUN19 $100-strike CALLs are priced right now at $110 with an initial SPAN minimum deposit about about $750 ($650 BP effect) for a possible return of 14.6%; the expiration date on the JUN19 class is 165 days out on May 15, 2019.

Crude Oil Options Expiration Dates

I do feel that waiting for some decrease in crude oil price volatility might be prudent – and also I’d like to get past the next OPEC meeting. Having said that, December could provide opportunities for crude oil short option traders to collect premiums in the months ahead – though I won’t be surprised if oil prices have some modest rise in the next few weeks. The volatility of the stock market seems likely to continue for a while – and this could limit crude oil price recovery.

If you’d like to gather more ideas for option sellers in 2019, consider subscribing to the OPTION INCOME TRADING BULLETIN‘s free trial. You get immediate access to more than 3 months of back issues, the next 14-days in real time, and our free list of Resource links for research. (you get instant full-access: no debit/credit card required for our free trial.) Use this LINK or hit the FREE TRIAL button below. Thank you and all the best for the coming holidays and the new year. – Don

Don Singletary