Nervous Stock Market Bodes Well for Gold Futures

Stock market uncertainty creates opportunity in option sellers gold puts for income. Historically, the greater the volatility and those daily sell-offs and run-ups of the stock market, the higher gold prices go. After a few small FED rate hikes in 2018, the FED has shifted to a more neutral policy for 2019 and beyond. Rate hikes have gone from very likely to unlikely in 2019. With interest rates very low -and likely to remain that way, investors in the stock market are more likely to react to volatile stocks by migrating funds into gold.

Conventional investors might see gold as a safe-haven to protect from a volatile and less dependable stock market. Many investors might see this as an opportunity to buy gold or CALL options to capture profits. For this strategy to be successful, the price of gold would have to rise. However, for option-traders who SELL options, there is a higher probability way to trade this market view of gold prices: Selling far out-of-the-money (OTM) PUT options could be a safer opportunity. The buyer of gold CALLS, futures, gold ETF’s, or owning the physical commodity would have to see prices go up to profit. There may be a smarter way to trade the stock market jitters:

Option Sellers Gold PUTS for Income

The SELLER of gold PUT options that are far OTM can profit under these scenarios:

- The price of gold remains the same.

- The price of gold goes up.

- The price of gold, goes down but stays above the far OTM put-option-strike.

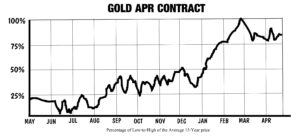

Let’s take a look at the gold futures contract, the April-2019 gold is currently trading about US$1256 / ounce:

As you can see from the chart (above), selling PUT-strikes far below the current market price of the APR19 gold futures could profit, no matter if gold remains the same, goes up – or just doesn’t go down more than $100 or more dollars per ounce. The options expiration date in this example using the APR19 class is March 25, 2019 – about 100 days out from the date of this article (early DEC2018.)

There is also a seasonal tendency (per 15-year average) for the price of the April gold futures to rise between December and April. The chart below indicates the percentage between the lowest and highest averages for the April gold futures over the last 15 years. read more about seasonal trading

High Probability of Success When Selling Options

There is a method to mathematically compute the probability that a specific option would likely expire worthless and OTM (out-of of-the-money) at expiration. Using a derivation of the famous Black-Scholes formula, this method uses the distance OTM of the strike, the volatility of the underlying futures, current interest rates, and current price of the underlying to compute the “Prob OTM” – the Probability of the option expiring (worthless) OTM. You should know this method is pure math and does NOT take into account other important factors such as the stock market behavior, the FED actions and views, the seasonal price tendencies, or the fundamental supply-demand of the commodity. This “Prob OTM” is shown on some trading software and calculated for you.

If your software doesn’t provide the “Prob OTM”, no problem: There is an easy rule-of-thumb method that is very accurate: Just subtract the option’s delta from one. Example: The current delta of the Apr19 1100-strike PUT option is 0.03 and 1.0 minus 0.03 = .97, which translates to a 97% Prob OTM for this option at this time.

You may want to consider learning this type of trading to use for a portion of your funds during times of stock market volatility. There are huge advantages of using commodity options over stock options.

Of course a trader could use other strike selections, other gold futures – such as June-2019, and also other strategies like using a vertical credit PUT spread. I usually prefer to sell the naked option, while riskier – it does have a higher ROI (return-on-investment) while still having a very high Prob. OTM. This article presents a neutral to bullish market view on gold futures. If a trader has a neutral market view, short strangles might be a suitable strategy to use. My book Selling Commodity Options – The Time Farming Income Machine discusses this type of trading – and is available on Amazon w/ free Prime shipping.

Selling commodity options can be risky, so you should study and practice prior to using this method. It can be very risky and is not appropriate for all investors. If you’d like to read more about it, you may wish to consider a free trial to my newsletter, the Option Income Training Bulletin (no credit/debit card req.) that discusses real trades in real time so you can learn more about this type of trading. You get to see it work

Don Singletary