Why consider selling options? More than 80% of all options expire worthless. These incredible odds are why thousands of new traders join the ranks of option-sellers every month. But there’s more: There are inherent advantages of selling commodity options over stock options.

Ultra-Low Delta / High Probability Trading – is the Key to Profits

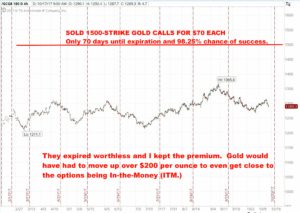

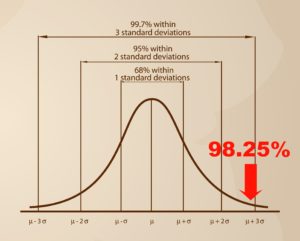

Unlike stock options, selling commodity options often has attractive premiums even when they are very FOTM (Far-Out-of-The-Money.) Here’s an example where I sold Gold 1500-strike CALLs for $70 each. The underlying contract of gold was trading near $1290 per ounce. The “Prob OTM” (probability it would expire OTM) was 98.24% and the delta of the option was near 0.02 (this is 25 times lower than at-the-money stock options.)

To make money, I only have to sell options WHERE PRICES WON’T GO. I don’t have to guess where prices will be.

You can easily see from the one-year gold price chart (above) that gold had not moved but $154 in price in the whole year (H=1365.8 L=1211.1). For me to lose money, it would have had to move up $210 in less than 70 days. There was a 98.25% chance that would NOT happen. This was a HIGH PROBABILITY – ULTRA LOW DELTA TRADE.

Unlike stock options, commodity options often have much lower initial margin requirements to trade them. This is because of special SPAN margin requirements on commodities.

Low Margin Requirements

What is ‘SPAN Margin‘? … This is a leading margin system, which has been adopted by most options and futures exchanges around the world. SPAN is based on a sophisticated set of algorithms that determine margin according to a global (total portfolio) assessment of the one-day risk for a trader’s account.

SPAN gives commodity and commodity option traders a marked advantage that allows traders special high leverage (more bang for the buck) than stock option traders.

Read here how I use ONE trade four or five times for even more profits with layered income.

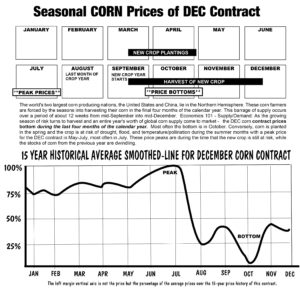

Seasonal Price Patterns That Enhance High Probability Trading

Strong historical seasonal price tendencies in agricultural commodities bring another amazing advantage in many agricultural commodity markets. Almost every summer in North America, I am able to take advantage of a very strong seasonal tendency for Corn prices to decline as the fall harvest approaches. Look at this strong seasonal price curve in the chart below:

As seasonal prices peak near June and July, I am able to sell Corn CALL options far above the seasonal peak prices and find trades with 95%+ in my favor, PLUS I get the extra boost of using trades in harmony the the strongest force of all, Mother Nature. This can actually add significantly to the already high probability of profit of such trades. Here is a representation of how strong seasonal price patterns can boost a short CALL trade:

Between JULY and DECEMBER, Corn prices peak in summer -and then decrease as the harvest progresses into the fall season giving an advantage to CALL sellers. Note the “flat tail” expansion on the low-side probability curve, while the upside shortens. This illustrates the seasonal price advantage for CALL seller.

To read about Feb Rate Hikes Creating Income Trades for Gold in 2018, Look HERE

Strong Seasonal Price Patterns

- Crude

- Natural Gas

- Corn

- Wheat

- Soybeans

- Cocoa

- Coffee

- Cotton, and more. Read more on seasonal trades

Non-Correlation to the Stock Market is a Major Advantage

For stocks, the DOW is the tide that rises and falls all boats. Not so with commodities. You may never have to fear a stock market crash again – ever! Read more here

SELLING COMMODITY OPTIONS has been a staple of Professional Traders for years. Now you can do it too and I’ll show you how with my newsletter:

Time Farming Training Bulletin – FREE 60-Day Trial

I want to show you a truly smoother, better, smarter way to make money by selling commodity options – and I’ll prove it to you FREE.

Here’s what you get:

- I send you my personal trades, the same day I place them (usually after 2pm Eastern.)

- You get price charts and seasonal price history charts on each trade

- Option Matrix screen shots of my trades (usually ThinkOrSwim)

- Fundamental analysis including USDA data and other crop information

- My personal commentary with tips for assessing your own trades

- A Discussion of the How/Why I selected the trade

- You get an absolutely FREE 60-Day Trial

- Three Months of Back Issues: You get to study many trades in my current positions and see how they are working.

- Articles on this strategy and helpful information on trade selection.

- No Credit or Debit Card required for free trial, only your name and email.

- You can apply for Annual and Monthly Plans for subscribers, after your trial period if you wish.

4 Huge Advantages of Selling Options on Commodities Instead of Stock Options:

- Ultra-Low Delta / High Probability

- Low Margin Requirements – High Leverage

- Seasonal Price Trend Advantages

- Non-Correlation to Stock Market

These are precisely the reasons that the Pros use this type of trading all the time.

Right now you can get 5 months of learning (3 months back-issues + 2 month free trial on new issues) from the Time Farming Training Bulletin – and you won’t risk a dime.

My new book on Selling Commodity Options is now available for under $20 with free Prime shipping at Amazon

I’ll also show you how to use professional-type money management in your trading account.

This material, the book and the newsletter, are especially for small and medium sized personal investors who trade online.

Hope is not a strategy. Learn to trade the right way and you won’t need to get lucky to make money. You can trade with math and dependable information on your side from now on. This is your chance to develop professional trading skills in a short amount of time.

ACT NOW Your FREE 60-Day trial is waiting.

Don A. Singletary is a veteran 30-year commodity trader who worked as a private consultant for large corporations for over 25 years to help his clients implement commodity options into their risk-management trading accounts. He has written for Stocks & Commodities Magazine, Futures Magazine, and been published in numerous blogs and radio programs. He is not a broker, trade advisor, or money manager– but a writer and educator who helps small and medium investors find ways to use their home computers and investment accounts to build financial security. He is author of several best-selling investment books including Options Exposed – The Most Popular and Profitable Option Strategies of All Time. His latest book: Selling Commodity Options – The Time Farming Income Machine is acclaimed for it’s plain language approach to selling commodity options.

Don A. Singletary