Soybean Fundamentals

Selecting soybean call option for profits: I often stress the importance of following the grain fundamentals via the USDA reports, especially the WASDE (World Supply-Demand Estimates.) The current corn harvest in progress has a tremendous yield of over 180 bushels per acre, but corn demand is also doing well. In 2019 more gasoline blends of 15% (corn made) ethanol will be sold per recent changes in USA laws and policies – and there will be even more demand for corn. The ending stocks for United States corn will be down for 2018-1019’s season (the “new crop”), which will be supportive of pricing. Soybeans are a totally different story, stocks are abundant and China has suspended imports from the United States (China is by far the main importer /customer of USA produced soybeans.)

-

WASDE World Agriculture Supply-Demand Estimates These reports are monthly usually around the 10th of each month, exact dates can be found along with the latest report at this link: WASDE

The reason we discuss Corn in an article about Soybeans is that – in the United States of America – depending on prices and available stocks – farmers will switch planting (acreage) from one of these crops to the other. Plainly put, if USA farmers can make more money planting corn than soybeans, they will use available acres to their advantage. A recent article by Jerry Gulke, held an informative discussion about prices of corn and soybeans versus projected planting acreage – and he made some important observations about price scenarios:

“…….If corn acres don’t increase by more than 4 million next year, 2019/20 ending stocks should stay below 2 billion bushels. However, the U.S. soybean balance sheet, without China, will require a 10-million-acre reduction to convince the trade $10 is in the future. Here is the long-term history of some soybean fundamentals……” The entire article by Mr. Gulke (10/24/2018) is available on AgWeb.com here: source

In order for corn’s price outlook to remain bullish, the USA ending stocks in 2019 should point to a value under 2 billion bushels. By contrast, Mr. Gulke suggests the possibility that without a 10 million acre reduction in USA soybean plantings (acreage), soybeans prices will likely not make it up to $10 per bushel. Here’s a graph that illustrates this abundance of soybeans in 2019; the amount of soybean stocks could nearly double:(source CME)

A soybean call option to consider:

This chart (below) is from Kansas State Univ’s Ag Economics Dept. Special thanks to: Rich Llewelyn, Ph.D., Coordinator and Extension Assistant. source: KSU web site. This “Soybean Price vs. Ending Stocks” is very revealing. If you look carefully at the vertical lines (the far right in RED is the 2018-2019 STU indicator, The BLUE is this season (2017-2018.) It is easy to see the STU for next season is about twice that of recent seasons. The small RED square (far right on the red vertical line) indicates the projected average price for soybeans next season (below $9.00/ bushel.)

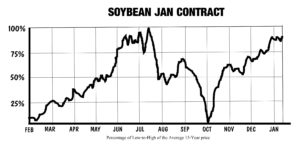

Soybeans could have an uphill battle to top a $10 /bushel price. This blog is all about finding agricultural commodity options to sell – and soybeans present an opportunity. First, let’s examine the average 15-year seasonal price pattern for both the JAN and the MAR soybean contracts (the percentage of low-to-high price extremes):

source of charts: My book: Seasonal Commodity Charts – Designed by Mother Nature available on AMAZON.COM w/free Prime shipping.

You can see (JAN & MAR 15-year patterns) that the JAN and MAR soybean futures clearly have a pattern of rising from OCT into the following MAR. If the STU wasn’t twice that of last year, I’d be looking at selling PUT options on the JAN19 and MAR19 soybean futures. With the 2018-2019 STU projected at twice that of the previous season, this time I’m looking for peak soybean prices in JAN19 and MAR19 not to exceed something around $10 per bushel. Here’s a chart from earlier in 2018 of the MAR18 soybean futures:

You can see (above) that the MAR18 topped out near a price of $10.71 / bushel and a low of around $9.44. The low for the MAR19 futures has been down to $8.38, more than a dollar below the MAR18 contract’s low (see above chart.) For these reasons, I am looking to sell selected CALL strikes at 1000 and higher on either/or JAN19 or MAR19 soybeans.

It is tempting to consider: Using SPAN minimum initial margins and selling the soybean call option – the 1000-strike MAR19 Soybean CALL has a possible yield of: $212.50 option premium/$584.75 Buying Power effect = a gain, excluding commissions, of 36% in about 4 months until expiration (an annualized yield of about 108%.) Other strikes farther OTM offer less risk and still attractive possible returns. I will be shopping these options over the next two weeks and publishing my own trades and research in my newsletter Option Income Training Bulletin. This article is typical of the type of research and fundamental analysis I publish in the newsletter. Most of the trades I make have Prob. OTM (a probability of expiring worthless) of near 95%. This is the only newsletter of its kind that teaches small/medium personal investors using discount brokers how to sell commodity options for income. I am not a trade advisor or broker; I am a writer and educator with 25 years as a commodity options hedge-risk-manager for major corporations. My job is help small/medium traders learn how to use this strategy that until recently was for only wealthy investors and money-managers.

If you’d like to learn more about this type of trading, sign up for a free trial to my newsletter. No credit or debit card required just your name/email.

Good trading to all – Don

Don A. Singletary