If you trading options was complicated, watch this!

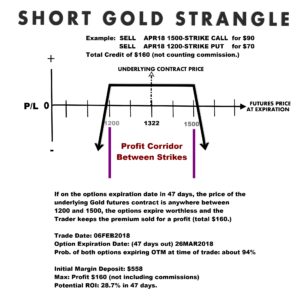

A SHORT STRANGLE is: When you sell an out-of-the-money CALL and PUT at the same time, collecting a credit to your account. If the underlying (futures contract) expires anywhere between the PUT strike and the CALL strike, you make money. This trading method is specifically for small and medium personal investors trading using on-line discount brokers.

Short Strangle

The marvel of this strategy is that you do NOT have to try and guess the WHERE and WHEN prices will go. You make money merely by picking a wide range where prices are likely NOT to go, then let the natural time-decay of the options do the work. In this case, the APR18 Gold futures will need to be between the range of $1200 and $1500 at option expiration in 47 days.

This is one of many such trades placed in recent issues of the subscriber-based Time Farming Training Bulletin. read more…

You can find out more about selling options on Gold Futures …. read more

See how a new wave of traders are learning these money-making strategies to make a second income at my Amazon book listing: Selling Commodity Options

Here’s how to use the same math that insurance companies and casinos use – to make high probability trades: read more..

You get three months of back issues, plus the next two months of issues – 5 months total – with our FREE 60-Day trial of the Time Farming Training Bulletin (no credit card required) read more here.

Thank you and good trading. – Don A. Singletary

Be Advised: These illustrations & text are for educational purposes only. Futures and options on futures trading are risky and not for everyone.