Posted: 10 SEP 2019

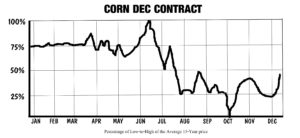

It is now about the second week of September 2019. The Northern Hemisphere corn crop is just beginning the harvest. As the harvest progresses, there is less risk to production of the crop as it is gathered. There is a strong seasonal tendency for prices to decline from JULY to OCTOBER each year. Here’s the 15 year history of this decline, basis the DEC corn contract:

This has been a bit of an irregular year. Flooding in the United States delayed planting in some areas and prevented it in others. If farmers cannot plant by a certain date, they will often switch to other crops like soybeans; this is because late-plantings will usually result in low yields cutting into potential profits. This is what happened this year in North America. The USDA, United States Dept. of Agriculture, did a special survey to try and ascertain how many acres of corn might be harvested this year, but at this date many traders and farmers think the USDA survey might not have fully captured the most accurate ‘planted acres’ number.

The USDA report this Thursday, 12 September, is expected to make some adjustments to the report to more accurately reflect the planting and expected harvested acres for the crop. For this reason, prices –basis the DEC19 corn contract- may be a little higher than normal. After the report this week, the expected yield numbers will be known. As the more reliable crop yield is available and harvest begins, it is much easier for traders to estimate the highest price levels for the season ( to help me determine which strikes of CALLs to sell.)

As a seller of commodity options, I like to make seasonal trades like this. After this week’s report, I will be selling CALL options on the DEC19 Corn futures at a strike that should be well above the seasonal high prices for the calendar year. I expect to sell CALL options on DEC19 corn futures that have a 90% chance or higher of expiring worthless. These options will expire in mid November 2019. My goal is to keep the premium I collected when I sell the options.

Normally I sell CALLS on the DEC corn futures earlier in the year, but this year, special circumstances have delayed getting accurate crop yield information, so I have waiting until the report coming up later this week to make this trade. If you would like to find out, the decisions I make and the trades I will likely place, please sign up for a free trial of my Option Income Training Bulletin (and read along with my subscribers/ it’s free!) All issues of my newsletter for the past year are available there free at any time. My newsletter teaches traders this very unique method of trading. A FREE 14-day trial to my Option Income Training Bulletin – is available at this link (button below):

Thank you – Don

Don A. Singletary