Frequently Asked Questions: Selling Commodity Options for Income

Option Selling for Income is not as common as you might think, even though professional traders do it every day. I get a lot of great questions as readers of my books and blog contact me. It makes sense to post some answers so everyone can easily get the information.

Question: Do you recommend any particular SPAN margin brokers?

Answer: This one has very low commissions and easy to learn/use. Here is my affiliate link with a FREE offer for two free trading books: http://www.tastyworksfreestuff.com

Question: IB margins are a little OTT margin-wise and saw that “XYZ Brokerage” specializes in SPAN margin for commodity option sellers?

Answer: I think the phrase “offers minimum SPAN margins” might be a more correct way to say it. A broker’s lowest requirements are a matter of policy for each brokerage company; many of them offer SPAN minimums to attract business. “SPAN minimum requirement” is the least money a trader must have in deposits to initiate a trade. The lower the margin requirements, the higher ROI a trader can make. This is a great question to ask a potential broker: “Do you offer SPAN minimum margins?” They get asked that all the time. How can you find out what the SPAN initial margin requirement is before you place a trade? In a pop up window right before you send a trade order. A line called “Buying Power Effect”; this is the amount of money required on deposit (the “initial margin”) required to place the trade. If a broker does not provide a way for you to know the margin before you place the trade, it can be very annoying. This often does not bother very experienced traders because they have a good approximation of what it will be – due to their experience. If you are not sure about how your broker or soon-to-be broker handles this, ask them.

What Returns Can You Expect from Selling Commodity Options for Income:

Question: I am getting closer to retirement and I like the idea of balancing my pure stock investments and speculative (directional) trading activities with a third leg (type of investments) selling commodity options. In your opinion, would it be reasonable to aim for a 10% – 15% annual return once proficient in this new area? And if so, what would you reckon the average/typical (SPAN) margin utilization of the account would be at any one point in time on the road to those returns?

Answer: This may be the question I get asked the most. Is 10% – 15% a reasonable expectation of returns? The short answer is “yes, but….” I also get asked why I don’t take the summary sheet of my personal trades and post an ROI (Return On Investment.) First of all, I want to repeat here that the rule-of-thumb would be that account utilization for margin be from 25% to %50. During a trade, after a trader posts the ‘minimum initial margin requirement‘, the margin requirements of one’s account are re-computed at the close of business each trading day; this process is called “marked to the market.” This means, that a trader can be required to put up additional funds when/if a trade goes against him or her. So you have to have reserves for this contingency. This is why you keep account utilization at 25% to %50. Without that reserve, the broker will issue a margin call with a short-term deadline, and the broker always has the right to liquidate your positions and restrict your trading if you get a margin call. Margin calls are not something you want to experience, as they can force you to liquidate a position at a loss almost instantly. Only utilizing 25% to %50 percent of your account balance will usually assure this doesn’t happen to you.

Now I’ll try to address the other part of this question, the expectation of a %10 to %15% return. I do think this return -or perhaps more – is within the scope of a responsible trader. To give this query an honest answer, I have to say it all depends on a trader’s:

- Risk Tolerance

- Choice of Trades

- Money Management (cutting losses and preserving capital)

- And the responsibility to have good research and reliable data on hand to evaluate trades while they are in progress

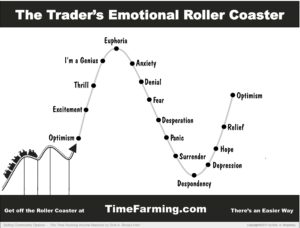

This is a good time to remind you the #1 reason, traders go broke. They let “bad” trades will small losses turn into bigger and bigger losses, instead of keeping losses small. “Hope” is not a strategy. Here’s the graphic I used in my book; this happens to way more traders of stocks, commodities, and everything else than you would want to believe:

Almost every experienced trader, if they are honest, can identify with this. They have “been there, done that.” If you want to know what will put you out of business and destroy your account, all you have to do is to expect to win every trade. It isn’t going to happen. This is the roller coaster you do not want to ride.

As in The Art of War. Sun Tzu’s advice to paraphrase: Do not fight battles you cannot win. In trader’s terms, take a small hit by withdrawal and then go fight battles you can win. It only takes one battle you cannot win to destroy you.

withdrawal and then go fight battles you can win. It only takes one battle you cannot win to destroy you.

If you examine my trades in the newsletter, you will find that I stay pretty close to the rule: ![]()

Let me say that sometimes I stay a little too long. If I collect $150 on an option when I sell it, the rules says when it doubles, to $300 – sell it and get out of the trade. Since I lost $300, and my initial credit was $150, my loss would be only $150. In reality, I might not get out until $200 or even $300 or more. What I will NOT do is let it run until I have a $1,000 loss. It really doesn’t matter if I lose $200, $300, or even $400 dollars; I can handle that. What I cannot handle is letting a ‘bad’ trade run up a $1,000 or $2,000 loss. A few of these that are tolerated can destroy a small account. THAT is what destroys accounts, not a $300 loss as opposed to a $200 loss. I am going to be brutally honest: If you don’t learn this, you won’t last!

YOU CAN GET A FREE TWO-WEEK TRIAL AND SEE THE ACTUAL TRADES I PLACE (SAME DAY). JUST SIGN UP FOR MY FREE NEWSLETTER TRIAL NOW: no credit/debit card required OPTION INCOME TRAINING BULLETIN – free trial offer: HERE or button below Join us and learn to trade for income from options.

If you have a questions send an email to me at Don@WriteThisDown.com Thank you and good trading. – Don