Option Trading Rules-of-Thumb for Success

These Five Option Trading Rules-of-Thumb can help you succeed. This is a simple way to remember some major points to help you succeed. Just remember this: 25-50%, 50%, 70%, 90%, and 200% The details are listed below.

Rule of thumb. The English phrase rule of thumb refers to a principle with broad application that is not intended to be strictly accurate or reliable for every situation. It refers to an easily learned and easily applied procedure or standard, based on practical experience rather than theory.

25% to 50% Margin Utilization

Try to keep your margin requirements on your trades as no more than 25% to 50% of your account balance. Every single day your account is “marked to the market” for margin requirements, and you never know when you might need them. This is why keeping requirements down to between 25% to 50% of your account balance is almost always a prudent thing to do. Running higher than this guideline can put you into a position where you MUST exit a trade to meet margin requirements – and that can mean forced losses. If you don’t understand margin requirements and how this all works, ask your broker and get some help so you can fully understand how it works immediately. Knowing this is absolutely essential.

50% Profit Rule

Some option sellers routinely exit a trade, or at least seriously consider doing so — when 50% of possible profits of a trade are already available. The larger your account is, the more margin money you have – and you might be inclined to just let the option expire worthless, unless you need to free up margin for other trades with more immediate potential. One thing you MUST always keep in mind is that holding a trade too long and trying to squeeze all the profits out – can result in losing the profits you already have available. Let me say this another way: You are actively choosing to risk the profits you have already made by holding the trade longer. So it’s best to be pretty sure there is no danger of this happening. If a market is volatile, taking your profits might be a good idea – and you may even have an opportunity to sell it (or a more farther out strike) again. Want more on this subject, see When To Take Profits.

70% Annualized ROI

If you sell and option for $200 that requires an initial margin of $800, and the option expires in 3 months. The ROI can be as high as 200/800 x 100 = 25% Annualized ROI would be 12/3 = 4, and 4 x 25% = 100% Annualized ROI is possible. (read more on computing the ROI here) That is just on this one trade; since you are only utilizing 25% to 50% or your margin, the return of your total account will be much less. Still, if a trader wants a “rule of thumb”, a sort of gauge to determine “Is this trade worth the money and time?,” the 70% ROI test might do. Of course the more risk adverse you are, the lower this number might be. You might sell a strike a lot farther OTM than another trader, in order to keep your risks in check. If you give this some thought you can probably come up with a number for your own “rule of thumb” percentage of ROI to evaluate the potential return of your trades. Some traders start out more carefully, and then – might raise this amount as they gain confidence. Always remember over-confidence can be too risky, so take it easy. Want to learn more about this see ROI figure return on your investment.

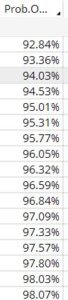

90%+ High Probability

There are very few trades where I sell an option on a commodity contract that doesn’t at least have a 90% or more chance of expiring worthless. Some of the option matrix in trading software label this “Prob. OTM” which means “the probability this option will expire worthless.” Ask your broker if your software has this notation (not all brokers name it the same thing.) If they don’t have it, no problem: Here another rule of thumb that allows you to compute it very easily. Get the delta of the option and subtract it from one. Example: Delta is 0.06, then 1.0 minus .06 = 94% Prob OTM. And always remember, this number does not take into account the fundamentals of a market. It is mostly based on time until expiration, how far out-of-the-money the strike is, and the volatility of the underlying contract.

200% Stop Losses

This one is simple – but might be the most important of all: When you sell an option and the trade goes against you, exit when the premium doubles – or at least very close to this guideline. Sometimes called “the 200% rule.” If you haven’t seen it yet, you might want to read this article on STOP LOSS. In the cases where I sell an option for less than $250 or so, I often tolerate a bit more than 200% due to the small amounts; this happens to be my personal choice and may or may not be suitable for anyone else.

Remember: These “Rules of Thumb” are only broad guidelines, but they can serve as a starting place for you to determine what best works for your own account, risk tolerance, and trading style. Psychologically, getting out of a losing trade is one of the hardest things for investors to do. Those that don’t learn how – usually fail. Tips that can help on this are in this post: Psychology of Trading

If you want to know more about selling commodity option, SIGN UP NOW FOR OUR FREE TRIAL OFFER. No credit/debit Card required, just your name/email. You’ll be glad you did. – Don