Building Regular Income Using Staggered Option Selling

Using passive income ladders is a technique used by many option-sellers to schedule recurrent income. For traders with an account large enough to provide ample margin deposits, this strategy can work particularly well as they can afford to sell options far out into the future, holding multiple short classes (different trading months) of options on the same underlying – placing more income rungs on the ladder so-to-speak.

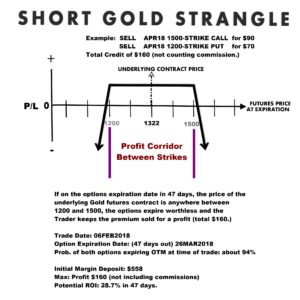

Subscribers to my newsletter know that I regularly keep short strangles open on Gold futures. Over the last year I have sold far OTM (out-of-the-money) CALLs and PUTs at the same time to form short strangles. This illustration shows one of the numerous short strangles I’ve placed on Gold futures during 2018 so far. This one is typical: (A trade placed on 06FEB2018 using the MAR18 class of options.)

(note: I always show illustrations of my trading in the newsletter - using only one (1) option per side. This is to keep my trade illustrations simple. Those that wish to consider a different number can easily calculate the credits and margins for themselves.)

The Short Strangle is Ideal for Range-Trading

Gold futures often trade in somewhat predictable ranges, options are available in all months of the calendar, and there is usually sufficient OI (open interest) to provide liquidity and fair pricing. The short strangle can be a great strategy choice for this setup and there is an opportunity to place trades in several trading months (classes) at the same time. Adding these ‘rungs’ on the income ladder will likely obligate margin money for long periods of time.

Turning Time Into Money

This means those funds are not available for shorter term trading opportunities, but for those with margin money to spare, this can be a great way to setup recurrent income and put dormant money to work. A great advantage of using short strangles is that they only require one margin deposit, even though there are two sides to the trade, which increases ROI. There are many commodities and scenarios that do not lend themselves the use of short strangles so easily. For example the grains have strong seasonal patterns, somewhat predictable patterns at different times of the year in a specific direction.

“Time is your friend; impulse is your enemy.” – John Bogle

Passive Income Ladders Also Work with Directional Trading.

I’ll use a hypothetical here to illustrate how to build a passive income ladder in the face of a very directional seasonal pattern: Experienced traders will recognize this well-known soybean seasonal pattern for the NOV futures contract. Prices for the NOV contract often peak each season around JULY and decline into OCTOBER:

Lets say it is the month of JULY and we hold a strong opinion (by our study of the fundamentals) that soybeans either have made a top, or will soon for the season. The northern hemisphere season means prices should decline from JULY into fall – as harvest progresses. We might choose to find CALL strikes far above the money(OTM), and then sell some in several option classes: Perhaps AUG, SEP, OCT, and NOV. So long as our assumptions about price movement are correct, some of those options would be expiring worthless, or you’d be buying them back (closing purchase) for profits during the next several months. This makes efficient use of your research and allows you to build income ladder rungs in several months, holding them all at sequentially staggered expiration dates creating income over a period of several months.

I hasten to point out that forming passive income ladders does NOT mean you must trade ALL the available classes (named months) of options. You might prefer to use only two classes for example. You should always check the CONTRACT SPECIFICATIONS of the underlying for the list of standard months in which options are available. There are non-standard months also, but if you use those – be sure and check for adequate liquidity -as indicated by the OI and the Volume of trading each day.

Maintain Some Diversification

Ideally, traders might have short option positions in a few different commodities to provide some diversity. If you only invest using one commodity, you are susceptible to the trade going wrong and you have all your eggs in one basket. On the other hand, if you trade in three or four different commodity groups – the risk is spread among several markets. By the way, it is quite common for traders to trade in just a few markets (3 to 6 perhaps) that they understand well. To think that simply trading more markets automatically makes you a more successful trader is not true.

“Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.”- Warren Buffett

Better to trade a few and to become master of those than to spread yourself too thinly. I have known traders (usually professionals) that specialize in only one or two markets – and they do remarkably well. It’s an individual choice of course and will be based on your knowledge and experiences. If you are new to commodity trading, I would recommend you study no more than three or four markets initially. Trying to learn them all at once can get cumbersome quickly. For example: You might start by looking into some of the grains, energy, and/or metals. Of course everyone’s background is different. You may come from an oil family, a cattle ranch, or grain farm and already have an understanding of a specific commodity. This could give you a head start. Or maybe you have a friend or business acquaintance who can share a useful background with you.

Summary & Time is Money

Although you might begin with a small/medium account and can’t yet afford to build passive income ladders, it is something to imagine in your future. The technique is quite common among wealthy investors and professional money-managers. As you gain experience and come to know price fundamentals and behavior of certain markets, you will gain confidence to expand your trading in this way. It is quite common to use this strategy in a limited way, perhaps only two passive income rungs on your ladder to start, then as you gain experience – you can progress to more when you see an opportunity.

Since Selling-Commodity-Options is not yet a widely known strategy for individual investors, it can be difficult to find anyone who is knowledgeable enough to engage in discussions on this trading. That is precisely why I post research, information, charts and discussions in my newsletter, the OPTION INCOME TRAINING BULLETIN. I do not give individual trading advice to subscribers; they are totally responsible for their own trade selections and management. I do post my own trades and commentary so readers can “look over my shoulder” as they learn. I have the only newsletter for selling commodity options that teaches others how to use the strategy. I encourage all people new to this type of trading to read and learn, and use the paper-money accounts so they can learn the software of their broker and gain knowledge as they “learn by doing,” always the best way of all to gain new skills that will allow you to trade smarter.

Good trading to you. – Don

Sign up for the FREE TRIAL NOW: (no debit/credit required just name and email.)

Don A. Singletary