The information here is a series of articles to help my readers and the visitors here learn to use what has to be one of the greatest strategies of all time. I’ll be posting articles here that help small and medium sized traders use a strategy that the pro’s have used for years. Thanks – Don A. Singletary

Using strong seasonal price tendencies of ag commodities to write far OTM options:

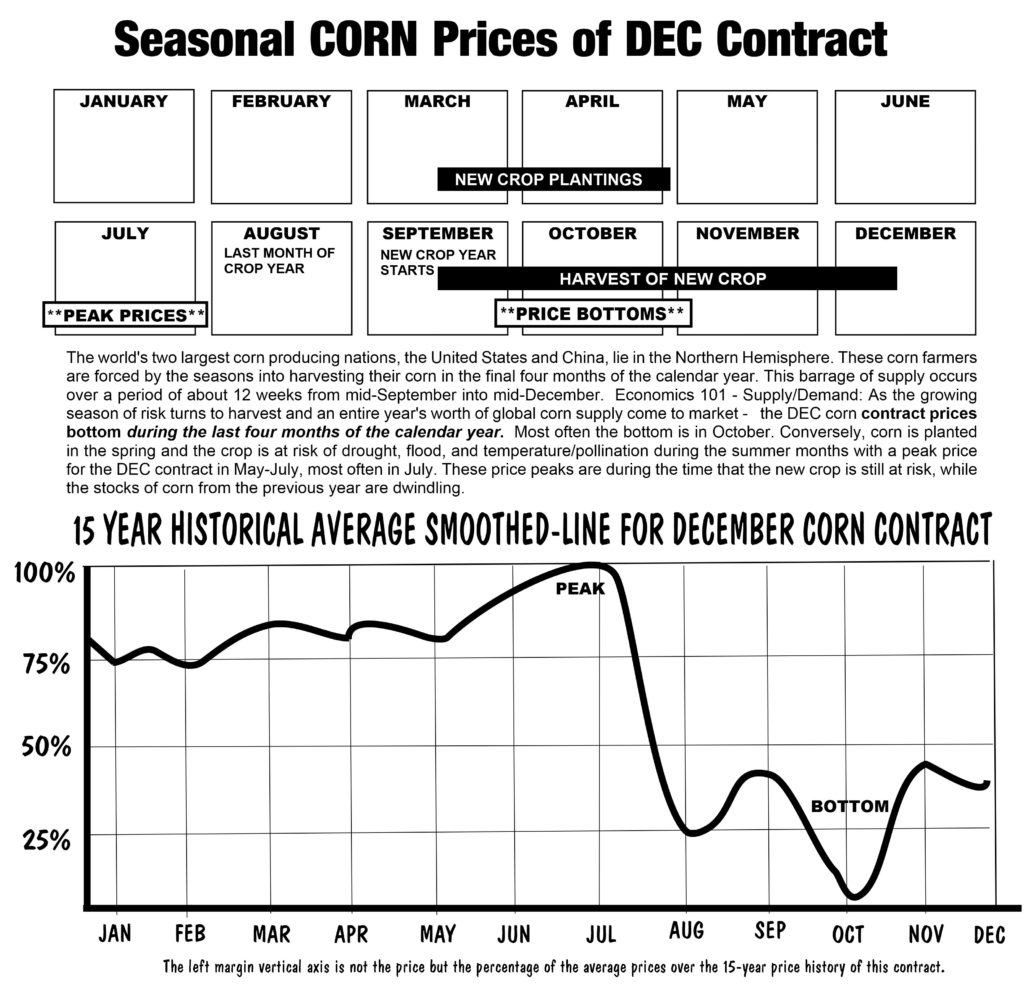

You can see how predictable the seasonal prices in Corn futures are. In June or July for the last three years, I have sold far out-of-the-money Corn futures CALLs. The chart on this page shows the 15-year average prices that dip after July into the last four months of the year.

This is exactly the kind of trades I place in my own private accounts. I study the fundamental of the corn market and the basic supply-demand dictates limits on prices. I don’t have to try and guess where prices will go, I only have to be able to discern where they are not likely to go -then I sell OTM options, then sit back and let time-decay have the options expire worthless and/or close out the positions prior to expiration for profits.

You can follow along in my Time Farming Training Bulletins year round as I publish the trades in my personal account, so you can learn how to use this great strategy. You’ll find out first hand why I call it the “#1 Option Strategy in the World.”

Right now, you can sign up for 60-day FREE trial; just go to TimeFarming.com to start your trial today.

Currently, I have trades on in Crude Oil, Natural Gas, Cotton, Corn, Soybeans, and Gold. I have sold far out-of-the-money options and all of these trades. Subscribe to the newsletter and follow along; I ‘ll show you how it’s done. – Don

There is no credit card required, only your name and email. A free 60-day trial of the Time Farming Training Bulletin. If you have options experience, you will be amazed as you follow along and learn this type of trading.