Soybeans and Corn

Commodity trading can be an alternative to stock market volatility. With the government shutdown stretching on, there was not a WASDE (WAS’-dee) (World Agriculture Supply-Demand Estimate) Report from the USDA in January. This report is very important to grain traders; it contains the production, exports, domestic use, and projects the yields for new crops, and states the storage stocks for corn, soybeans, wheat. So grain traders are a bit “in the dark,” without updated information in these monthly reports.

Soybean exports to China for this recent season are down 40% due to tariff disputes. Even prior to the reduced export number, there is an almost record high stocks for soybeans already. The trade talks between USA and China are in session again and are expected to last until the end of January 2019. Both corn and soybean prices were a little higher this week, as rumors abounded about tariff removals as a negotiation tactic were in the news. The United States representative denied the rumors as the negotiations continue.

While soybeans prices are neutral to bearish due to large stocks, the fundamentals of the corn market indicate average prices for the new crop, the crop to be planted in March through May 2019, will increase from last seasons average of $3.36 per bushel to around $3.60 per bushel.

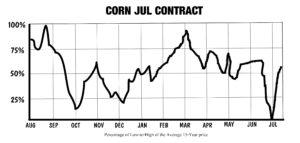

The (above) 15-year average price chart for the JULY corn contract, indicates that this pattern normally has a seasonal pattern price peak during MAR. Currently, the JUL19 corn price is near 397.75 and I am shopping to sell PUTS well below the money on the JUL19 contract. I already hold positions with short PUTS on the MAY19 contract.

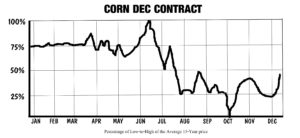

Later this year, there may be an opportunity to sell CALL options on the DEC19 Corn. As you can see in the chart below, the DEC average price usually peaks between MAY into JULY.

This is a great example of using seasonal price patterns to capture profits both as prices go UP and later in the season, when they go DOWN.

Commodity Trading Crude Oil & Gold

Crude oil is finding a new trading range in the new year. Generally, the consensus is that – based on supply-demand fundamentals – that a fair price is $48 to $58 a barrel. This opens the door to sell option premium at strikes far OTM (Out-of-the-Money) on both sides of that range. Selling both CALLs and PUTs on contracts several months out has some attractive premium. The use of short strangles for a ranging commodity is a play with a higher ROI than since the trader can get twice the bang for the buck on margin money required. Short strangles, when they can be used offer this large advantage.

Gold has had a large run up in prices in recent months, the tariff disputes between China / USA, and a very volatile stock market worldwide resulted in a surge of buyers for gold as safe-haven seekers – and hedges against inflation. This notion may have run its course for a while. The FED’s are currently neutral on raising rates again, and when the present government shutdown in the United States is over, there could be timing that allows the stock market to recoup some of the losses as averages move back up. Should this happen, we may see a cap on gold prices for a few months – and this is an opportunity for an option seller.

In my subscriber-based newsletter, the TIME FARMING TRAINING BULLETIN, I detail my personal trades based on current research, and supply charts and fundamental data that I use to find option-selling opportunities on a number of commodities. This new year 2019 will have many opportunities in the first half of this year. If you want to follow along, just sign up for a FREE TRIAL, there is no debit or credit card required. You get to follow along with these option selling trades to see how they work – and the returns that are available. It is risky, and not suitable for a retirement account, but there is good potential for income opportunities. I have articles here on this blog about money management, risk, and some discussions about terms and strategies.

My newsletter is not a trade advisory service, nor do I sell software. I provide information to help individual investors learn about option-selling opportunities, the risks involved, and examples of charts and research sources to help traders learn more about selling commodity options. The free trial link is here: FREE TRIAL Your name, and email is all that is required for a 60-day trial.

My book on seasonal price charts is available on Amazon HERE. – Don Singletary